El futuro de la agricultura ya no depende solo del clima, sino de la tecnología…

Driving the Creation of Investment Funds for Family Offices and Trade Associations in Chile, connecting USA, Mexico, Latam, Asia and Europe.

With the goal of transforming passive capital into high-impact strategic assets, a new strategy is emerging focused on structuring investment funds designed specifically for Family Offices and Trade Associations.

The strategy is led by Juan Carlos Nuñez Agreda of URKAN Innovación y Proyectos and agronomist engineer Maximiliano Morales, with a focus on connecting the wealth of Family Offices and the collective strength of industry associations in Chile with scalable projects in critical sectors such as Fintech, Deep Tech, AgTech, Logistics, Last-Mile solutions, and ClimateTech.

Intelligent Capital Structuring: The Role of Family Offices and Trade Associations

One of the pillars of this initiative is the design of investment vehicles that enable Family Offices to diversify their portfolios toward science- and technology-based assets, as well as enabling infrastructure.

“Today, a well-designed structure of financial and industry alliances can reduce a project’s international time-to-market from 24 to just 9 months. It’s not only about providing capital, but about designing governance models and funds that support innovation in the territories where their own companies operate,” explains Juan Carlos Núñez, Director of URKAN.

The strategy includes the creation of investment networks linking local capital (Chile) with markets in Mexico, the United States, Asia, and Europe, positioning Chilean investors as key partners in global logistics corridors. At the same time, it seeks to foster genuine regional economic development, particularly in rural areas where economic activity is declining due to water scarcity and the migration of young people to cities.

A Structured Investment Portfolio

This initiative not only identifies projects, but also structures them to become investable assets for both institutional and private investors. The portfolio focuses on:

- Infrastructure and Logistics: Investments in last-mile solutions, the maritime sector, and the modernization of port infrastructure.

- Natural Resources and Climate: Deep Tech applied to mining, energy, water monitoring systems, and ClimateTech.

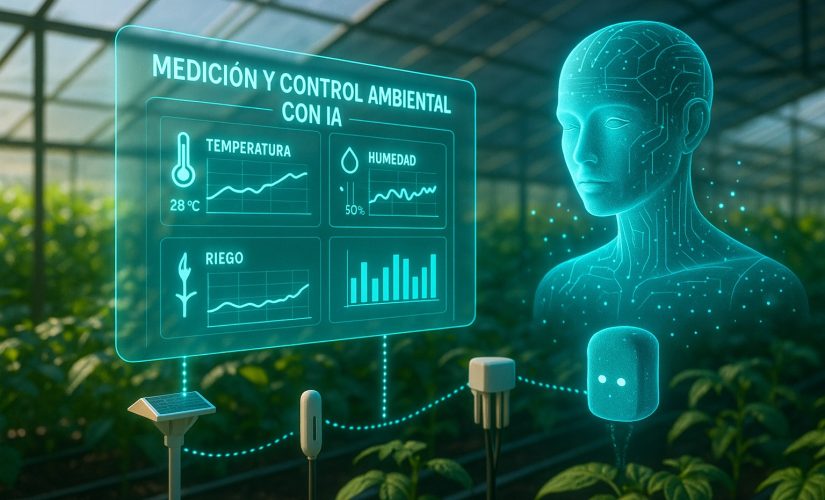

- AgTech and Biotechnology: Genetic recovery of crops, precision agriculture, smart irrigation, and AI-driven data science.

- PropTech: Urban development in intermediate cities and coastal areas.

- FinTech: Development of financial technology sector

Chile as a Technological Validation Lab

For investors, Chile offers unique advantages as a “laboratory country.” The strategy leverages the nation’s productive diversity and its mining and port infrastructure to pilot and validate technologies before global scaling.

“Our aim is for trade associations and Family Offices to actively participate in value creation. Chile has the potential to consolidate itself as a technological and scientific hub if we successfully connect applied knowledge with long-term strategic capital,” emphasizes Maximiliano Morales.

Action Pillars for Investors

To strengthen on-the-ground impact, the following actions will be implemented:

- Identification and structuring of investable projects with a clear investment thesis.

- Coordination of investment syndicates among sectoral associations and logistics stakeholders.

- Development of pilot zones to ensure technical feasibility prior to capital deployment.

- Technology missions to connect local capital with international investment ecosystems.

More information: WhatsApp +56 9 3251 7848 or max@amixtechlab.com

Comments (0)